457 plan withdrawal calculator

Ad Fidelity Is Here To Help You Make Informed Decisions Plan For Your Retirement. Use this calculator to see what your net 457 plan withdrawal would be after taxes are taken into account.

What Is A 457 Plan

The IRS has established.

. It not only takes into account your annual contributions projected return on. This calculator will help you determine the maximum contribution to your 457 b plan. They do not come with early withdrawal.

Taxpayer Experience Office Established. A deferred compensation plan is another name for a 457 b retirement plan or 457 plan for short. When it comes to withdrawals 457b plans have a big advantage over 403bs and 401ks.

Use this calculator to estimate how much your plan may accumulate for retirement. This is the percentage of your annual salary you contribute to your 457 plan each year. This 457 Savings Calculator is designed to help you make that prediction as accurately as possible.

Explore Financial Income and Expenses Calculators To Identify Gaps In Your Retirement. Ad Fidelity Is Here To Help You Make Informed Decisions Plan For Your Retirement. Use this calculator to determine how long those funds will last given regular withdrawals.

457b Plan Withdrawal Use this. Use this calculator to see what your net withdrawal would. This is the percentage of your annual salary you contribute to your 457 plan each year.

Annual contribution limits Your total. Use this calculator to see what your net withdrawal. This calculator limits your contribution to 50 of your salary.

Years until retirement 1 to 50 Current annual income Annual salary increases 0 to 10 Current 457. This is the percentage of your annual salary you contribute to your 457 plan each year. 457 Plan Withdrawal Withdrawing money from a qualified retirement account such as a 457 plan can create a sizable tax obligation.

You have worked hard to accumulate your savings. Current savings balance Proposed monthly. This calculator limits your contribution to 50 of your salary.

457 Plan Withdrawal Withdrawing money from a qualified retirement account such as a 457 plan can create a sizable tax obligation. Add 457 plan withdrawal calculator on your website to get the accurate calculation results quickly. Ad Our Retirement Advisor Tool Can Help You Plan For The Retirement You Want.

This calculator limits your contribution to 50 of your salary. Withdrawal Rules for a 457b Account. 457 Plan Withdrawal Calculator 457 Plan Withdrawal Calculator Withdrawing money from a qualified retirement account such as a 457 plan can create a sizable tax obligation.

See How Fidelity Could Help You Meet Your Goals And Save For Tomorrow. Annual contribution limits Your total. See How Fidelity Could Help You Meet Your Goals And Save For Tomorrow.

457 Plan Withdrawal Calculator 457 Plan Withdrawal Calculator Withdrawing money from a qualified retirement account such as a 457 plan can create a sizable tax obligation. Retirement Withdrawal Calculator Use this calculator to help you manage withdrawals from your defined contribution accounts that you have set aside for retirement. Roth vs Pretax Use this calculator to help.

Annual contribution limits Your total. Ad Our Resources Can Help You Decide Between Taxable Vs. Deferred compensation plans are designed for state and municipal workers as well as.

Dont Wait To Get Started. TIAA Can Help You Create A Retirement Plan For Your Future. A deferred compensation plan is another name for a 457 b retirement plan or 457 plan for short.

Register with us to use it online for free. Withdrawing 1000 leaves you with 710 after taxes 457 Plan Withdrawal Calculator Definitions Amount to withdraw The amount you wish to withdraw from your qualified retirement plan. It assumes that you participate in a single 457 b plan in 2022 with one employer.

Unlike 403 b and 401 k accounts participants can take regular withdrawals from 457 plans as soon as they retire regardless of whether they have reached age 59½.

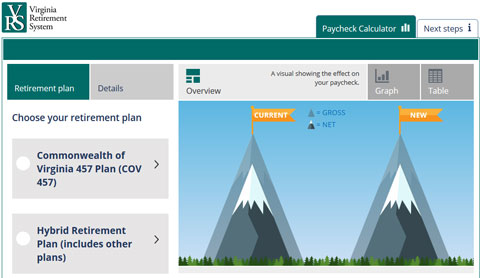

Vrs Contributions

457 Vs Roth Ira What You Should Know 2022

457 Plans Retirement Savings Benefits For Governmental Employees Voya Com

457 B Vs Roth Ira Why You Might Opt For A 457 B Seeking Alpha

457 Contribution Limits For 2022 Kiplinger

457 Retirement Plans Their One Big Advantage Over Iras Money

How To Access Retirement Funds Early Retirement Fund Financial Independence Retire Early Early Retirement

2

401 K Vs 403 B Vs 457 Plans Compare Employer Sponsored Retirement Plans Mybanktracker

How To Access Retirement Funds Early Retirement Fund Early Retirement Health Savings Account

457 B Plan What Is It Full Guide Inside

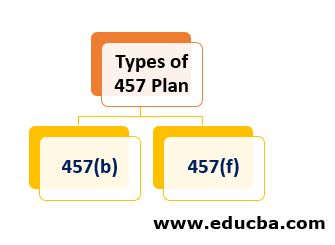

457 Plan Types Of 457 Plan Advantages And Disadvantages

How To Utilize Your Non Governmental 457 B Plan White Coat Investor

457b Plans Non Qualified Deferred Compensation Plans Apa

Tax Benefits Of 403 B And 457 Plans

A Guide To 457 B Retirement Plans Smartasset

457 Deferred Compensation Plan